CHAPTER 7

“The source of crony capitalism in China is the unrestrained power held by certain factions that lets them intervene in economic activity and allocate resources. Supporters of the old economy want to increase SOE monopoly power and strengthen government’s dictatorial power.”

Wu Jinglian, Caijing ![]()

September 28, 2009

There can be little doubt that the Chinese government’s initial policy objective was to create a group of companies that could compete globally. However, the National Team created by government policy was, from its inception, more politically than economically competitive and, as a consequence, these oligopolies came to own the government. At the same time, that bankers were creating National Champions, Zhu Rongji was, perhaps inadvertently, making it possible for these huge corporations to displace the government. In 1998, Premier Zhu forcefully carried out a major streamlining of central government agencies that reduced their staffing by over 50 percent and eliminated the great industrial ministries that had been created to support the Soviet-inspired planned economy. These included the Ministry of Coal Industry, the Ministry of Machine-Building, the Ministry of Metallurgy, the Ministry of Petroleum, the Ministry of Chemicals, and the Ministry of Power, all of which became small bureaus that were meant to regulate the newly created companies in their sectors. The new companies and the bureaus were collected under the now long-forgotten State Economic and Trade Commission (SETC).1

The ministries disappeared, the SETC was again reorganized, but the companies remained. Then, in 2004, the State-owned Assets Supervision and Administration Commission (SASAC) was created to bring order to the ownership of state enterprises. The SASAC was meant to be the owner of the major central SOEs on behalf of the state, and was endorsed as such by the State Council. But it has largely been a failure precisely because it was based on Soviet-inspired, top-down, organizational principles. Because of the stock markets, China in the twenty-first century has progressed far beyond this to the point where Western notions of enterprise ownership are used to trump the interests of the state. To illustrate this point, the SASAC’s relationship with its collection of central SOEs is contrasted to Central Huijin’s investments in China’s major financial institutions.

ZHU RONGJI’S GIFT: ORGANIZATIONAL STREAMLINING, 1998

The regulatory bureaus with which Zhu replaced the great ministries had far fewer staff than their predecessors. Even worse, their heads were not ministers, and lacked the seniority to speak directly to the chairmen and CEOs of the major corporations, who were, in many cases, the former ministry bosses of those left behind in the bureaus. In other words, by eliminating the industrial ministries and at the same time promoting the creation of the huge National Champions, Zhu Rongji effectively changed the ministries into Western-style corporations that were staffed by the same people at the top. However, he did not, or was unable to, change the substance.

That may have been because the former ministry officials now in charge of the new corporations successfully fought for the right to remain on the critical staffing hierarchy of the Chinese Communist Party. This would seem entirely natural given the Party’s desire to ensure its control over the economy. However, had these new corporations been staffed by men who were outside of the Party’s nomenklatura, things might have turned out differently and the political independence of the Party and government might have been preserved.

There was one crucial exception: in spite of all the financial clout they seem to wield, the Big 4 banks remain classified as only vice-ministerial entities. An entity is placed in the state organizational hierarchy based on the rank of its highest official; the chairmen/CEOs of these banks carry only a rank of vice-minister. The reason for this exception appears to be straightforward: the Party seems to have wanted to ensure that the banks remained subordinate entities, and not just to the State Council, but to the major SOEs as well. Banks were a mechanical financial facilitator in the Soviet system; the main focus of economic effort then was on the enterprises. Little has changed.

When transferring to these central SOEs (yangqi ![]() ) the former ministry officials were able to retain their positions on the Party list controlled by the central Organization Department. Today, 54 of the 100-plus central SOEs nominally managed by the SASAC are on what is called the central nomenklatura list. The chairmen/CEOs of these companies hold ministerial rank and are appointed directly by the Organization Department.2 These men rank equally with provincial governors and all ministers on China’s State Council, and many are members or alternates of the powerful Central Committee of the Communist Party of China (see Table 7.1). What would the chairman of China’s largest bank do if the chairman of PetroChina asked for a loan? He would say: “Thank you very much, how much, and for how long?”

) the former ministry officials were able to retain their positions on the Party list controlled by the central Organization Department. Today, 54 of the 100-plus central SOEs nominally managed by the SASAC are on what is called the central nomenklatura list. The chairmen/CEOs of these companies hold ministerial rank and are appointed directly by the Organization Department.2 These men rank equally with provincial governors and all ministers on China’s State Council, and many are members or alternates of the powerful Central Committee of the Communist Party of China (see Table 7.1). What would the chairman of China’s largest bank do if the chairman of PetroChina asked for a loan? He would say: “Thank you very much, how much, and for how long?”

TABLE 7.1 The National Team: Representation on the Central Committee (2009)

Source: Kjeld Erik Brodsgaard, “Politics and business group formation in China,” unpublished manuscript, April 2010

What then of the SASAC, the current entity charged with overseeing the central SOEs? The SASAC was established by the State Council in 2003 and had been created out of the SETC (see Endnote 1) and an agglomeration of other commissions and bureaus which previously had oversight of the central SOEs. It was created as a quasi-governmental entity (shiye danwei ![]() ) rather than a government ministry because such a powerful government entity would have attracted discussion at China’s “highest organ of state power,” the National People’s Congress (NPC). This was particularly so since there was a line of argument in support of the NPC as the proper entity to own state assets. This argument held that since the NPC was, in fact, the legal representative of “the whole people” under the Constitution, it was better placed than the State Council to play this role. As a result, the entire process establishing the SASAC was rushed through just before the NPC convened in March 2003.

) rather than a government ministry because such a powerful government entity would have attracted discussion at China’s “highest organ of state power,” the National People’s Congress (NPC). This was particularly so since there was a line of argument in support of the NPC as the proper entity to own state assets. This argument held that since the NPC was, in fact, the legal representative of “the whole people” under the Constitution, it was better placed than the State Council to play this role. As a result, the entire process establishing the SASAC was rushed through just before the NPC convened in March 2003.

One of the greatest considerations surrounded the issue of the new commission’s classification (guige ![]() ). For a moment it appeared that it would be similar to the Central Work Committee for Large Enterprises (daqi gongwei

). For a moment it appeared that it would be similar to the Central Work Committee for Large Enterprises (daqi gongwei ![]() ), the other of the SASAC’s two principal components, which was headed by a Party member at vice-premier level. The other choice was the arrangement at the SETC, with a ministry-level leader at the top. The final choice of the latter was a decision that weakened the SASAC almost fatally from the very beginning. Why should a major corporation owned by the Chinese central government be subject to the authority of what in the Chinese context is tantamount to a non-government organization (NGO) even if it was run by a minister? A vice-premier might have made the key difference.

), the other of the SASAC’s two principal components, which was headed by a Party member at vice-premier level. The other choice was the arrangement at the SETC, with a ministry-level leader at the top. The final choice of the latter was a decision that weakened the SASAC almost fatally from the very beginning. Why should a major corporation owned by the Chinese central government be subject to the authority of what in the Chinese context is tantamount to a non-government organization (NGO) even if it was run by a minister? A vice-premier might have made the key difference.

Despite its weak position in the state hierarchy, the SASAC was charged by the State Council with very significant responsibilities: 1) representing the state as owner of those central SOEs that together constitute the “socialist pillars” of the economy; 2) carrying out a human-resource function for SOE senior management; and 3) deciding where to invest dividends received from the SOEs. In each of these areas, the SASAC has had great difficulty exercising its authority, not simply because it is a sort of NGO, but also because its organizational relationship to its nominal charges was inappropriate.

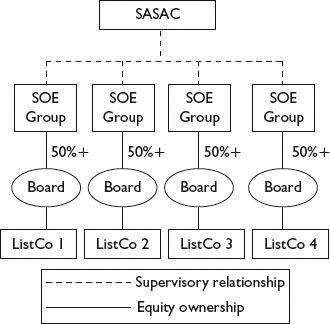

First of all, SASAC has been unable to address the simple fact that it was not the owner of these SOEs (see Figure 7.1). Previously, the industrial ministries could make such a claim since they were a component part of the government and, in fact, oversaw the investment process in their subordinate enterprises. After the strategic assets of these enterprise groups were spun off into listed companies, the remaining SOE group companies became, in fact, the direct state investors in the National Champions. In contrast, SASAC was tacked on after the old ministry systems were eliminated. Secondly, while SASAC could oversee the appointment of management at the vice-president and CFO levels, the Party’s all-powerful Organization Department appoints the chairmen/CEOs. How can even a governmental entity exercise authority over enterprises whose senior management has been appointed by the Organization Department? These chairmen/CEOs do not report to a government minister; they report directly on a solid line into the Party system.

FIGURE 7.1 SASAC’s “ownership” and supervisory lines over the National Team

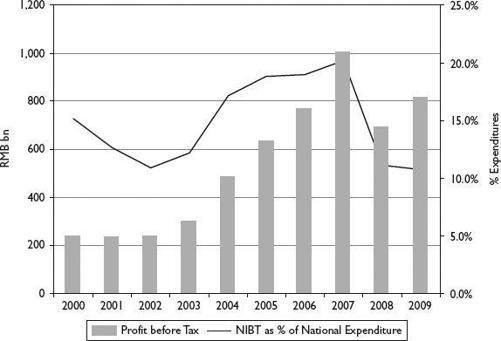

Finally, the delicacy of the SASAC’s position is well demonstrated by the fact that its “invested” companies have successfully resisted the payment of significant dividends, whether to the SASAC or the Ministry of Finance, despite a protracted struggle over the past few years. Even with a three-year “trial” compromise in place, reached in 2007 after years of wrangling, payments will be in the 5–10 percent range of post-tax profit, all of which has been used for projects that are equivalent to reinvesting into the SOEs. The profit made by these nominally state-owned enterprises is not small and in recent years has reached almost to 20 percent of China’s national budget expenditures (see Figure 7.2). This is a vast amount of money that would be better redirected at the country’s burgeoning budget deficit. Instead, because of their political and economic power, coupled with the ingenuous argument that they continue to bear the burden of the state’s social-welfare programs, the National Champions are able to retain the vast bulk of their earnings. The fact that the government is unable to access this capital is the best illustration of the power of these oligopolies.

FIGURE 7.2 Central SOE profit as a percentage of national budget expenditures

Source: 21st Century Business Herald 21 ![]() , August 9, 2010: 11

, August 9, 2010: 11

The architecture of the entire SASAC arrangement bears the hallmarks of the Soviet-style ministry system abolished by Zhu Rongji in 1998. In that system, SOEs reported directly to their respective ministries and were administratively managed by them (guikouguanli ![]() ); the Party organization was their nerve system. The relationship between ministry and enterprise was all-encompassing, including investment, human resources and the deployment of capital and other assets. When the ministries were abolished, the line to the past was broken. The SASAC could not take their place, even though its structure was predicated on the thought that the old administrative management methods still worked. At best, the SASAC as presently constituted is rather like the State Council’s Department of Compliance. China in the twenty-first century is no longer built on the Soviet model.

); the Party organization was their nerve system. The relationship between ministry and enterprise was all-encompassing, including investment, human resources and the deployment of capital and other assets. When the ministries were abolished, the line to the past was broken. The SASAC could not take their place, even though its structure was predicated on the thought that the old administrative management methods still worked. At best, the SASAC as presently constituted is rather like the State Council’s Department of Compliance. China in the twenty-first century is no longer built on the Soviet model.

The SASAC model vs. the Huijin model: Who owns what?

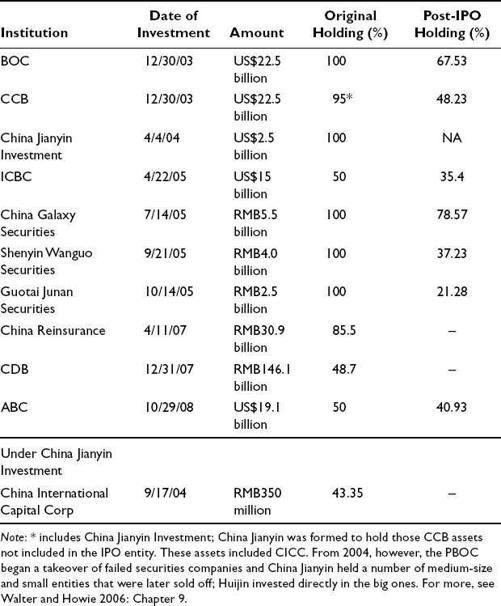

In deliberate contrast to the SASAC and taking full advantage of the international corporate model, the PBOC team created Central SAFE Investments (or Huijin), as a limited-liability investment company rather than a government body of any kind. Huijin was to be the critical part of the project to restructure the banks and was designed for the express purpose of investing directly in equity of the Big 4 banks. But it became much more than that (see Table 7.2). In late 2003, Huijin made cash investments totaling US$45 billion in CCB and BOC, acquiring almost 100 percent of their equity. In 2005, it invested a further US$15 billion in ICBC for a 50 percent holding.

TABLE 7.2 Huijin investments, the financial SASAC, FY2009

This direct holding was possible because of the “good” bank/“bad” bank approach described in Chapter 2. For SOE restructurings, the parent or group SOE that remained behind was effectively the “bad” bank and, at the same time, the majority shareholder of the “good” bank. Consequently, whatever dividends were paid went directly into the group’s coffers as the agency of the state. Removing non-performing assets to an entity owned by a nominal third party avoided this situation of having to create a holding company with the result that the state held direct equity interests in the banks. By 2005, Huijin had become the controlling shareholder on behalf of the state and enjoyed majority representation on the boards of directors of CCB and BOC and, together with the MOF, of ICBC, CDB, ABC and a host of other financial institutions.

In short, even after its acquisition by CIC in 2007 and no matter how it may be disposed of in 2010, it is in a position to directly control the decisions of these banks by a simple vote of its appointed directors at bank board meetings: senior bank management, having only vice-ministerial rank, had no excuses to prevaricate (see Figure 7.3). Of course, this all assumed that the Party agreed to Huijin’s positions, but, as Huijin’s continued operations over the years indicates, the structure has been viewed positively by the Party.

FIGURE 7.3 Huijin’s pre-IPO ownership and board control of the state banks

National Champions: The new government or the new Party?

The Party is able to ensure its control over China’s most powerful business groups by having the power to appoint their top management. Allowing the senior management of SOEs to retain their respective ranks within the Party nomenklatura after the dissolution of the ministries, however, created a fissure within the Party and government along business and political lines. In some sense, this was a pre-existing split in that families and friends of senior leaders had actively engaged in their own businesses since at least the early 1990s. But it is no longer simply a case of the sons and daughters of the rich and famous being out in the market selling influence. With access to huge cash flows, broad patronage systems and, in many cases, significant international networks, the senior executives of the National Champions can expect to succeed in lobbying the government for beneficial policies or even to set the policy agenda from the start. The sons, daughters and families now have institutional backing outside of the Party itself and this gives rise to questions over whether these business interests have, over the past decade, replaced the government apparatus or eroded the government from within. How accurate is the statement that “The business of China is business” and is this beneficial in a system of communist-style capitalism?

The case of Shandong Power

The notorious case of Shandong Power (Luneng) illustrates the consequences of Zhu Rongji’s elimination of the industrial ministries. In 2006, news was leaked out by Caijing ![]() magazine that the state-owned electric utility in Shandong province and a number of its major adjunct enterprises had been completely privatized.3 The company, a subsidiary of the State Power Corporation, was the largest enterprise in the province ahead of PetroChina’s subsidiary, Shengli Oil, Yanzhou Coal, and the well-known Haier Group. Its total assets of RMB73.8 billion (US$10 billion) and a total installed power-generating capacity of 360 gigawatts (second only to China Huaneng Group) had been acquired by two Beijing companies of uncertain background for a modest RMB3.7 billion (US$540 million). The name of the person behind the “acquisition” was well-known to market insiders and was (and remains) the president of a central-government enterprise group under SASAC, as well as an alternate member of the Central Committee. Caijing

magazine that the state-owned electric utility in Shandong province and a number of its major adjunct enterprises had been completely privatized.3 The company, a subsidiary of the State Power Corporation, was the largest enterprise in the province ahead of PetroChina’s subsidiary, Shengli Oil, Yanzhou Coal, and the well-known Haier Group. Its total assets of RMB73.8 billion (US$10 billion) and a total installed power-generating capacity of 360 gigawatts (second only to China Huaneng Group) had been acquired by two Beijing companies of uncertain background for a modest RMB3.7 billion (US$540 million). The name of the person behind the “acquisition” was well-known to market insiders and was (and remains) the president of a central-government enterprise group under SASAC, as well as an alternate member of the Central Committee. Caijing ![]() , of course, did not reveal his name; there was no need.

, of course, did not reveal his name; there was no need.

The transaction took place over a 10-year period and it was clear to the central government early on that a true privatization was in progress. In early 2003, an article in the 21st Century Business Herald gave rise to questions about an ongoing employee buy-out at Shandong Power and led to an enquiry being made at the State Council. In August that year, SASAC, the NDRC and the MOF jointly issued an emergency notice requiring that all transfers of ownership of power-related companies come to an immediate halt; apparently the same thing was happening all over the country. This notice referenced a State Council document of October 2000 that also had clearly called for a halt to any transfers of ownership in the power sector unless approved by the State Council. Neither of these documents had the least impact on the situation at Shandong Power; it is unclear what may have happened elsewhere.

By mid-2006 the two Beijing companies had acquired a 100 percent interest in Shandong Power from entities purportedly representing the company’s employees and staff including the company’s trade union. Representatives of the new shareholder were able to produce legal opinions claiming that the transaction was perfectly legitimate. Meanwhile, Caijing reported a senior official at the SASAC as saying: “We did not know a thing about this. Who would have thought that such a large transaction involving state assets would not be reported to the SASAC for approval?” This comment must be seen as extremely disingenuous or entirely facetious. Throughout 2004 and 2005 the SASAC had been actively investigating management buy-outs of SOEs across the country and had released notices seeking to standardize oversight procedures.

More realistic is the assessment of a former deputy head of the State Planning Commission who commented, as follows:

SASAC had once deliberated producing a document on how to deal with management buy-outs. In this document, there was a proposal suggesting that employees holding shares in power companies choose either to stay in the company and give up their shares or leave the enterprise (and keep their shares). In the end SASAC feared that the impact would be too large and it (the document) was unable to come out officially.4

In other words, the SASAC was afraid to create waves, even when it knew that state assets for which it was nominally responsible were actually being privatized. Was it afraid of the employees who were acquiring shares in Shandong Power? Certainly, there may have been some consideration of possible “social unrest” if staff were required to return any shares acquired. But the real fear related to the persons behind such transactions. When the sponsor of an activity is sufficiently senior in the central nomenklatura, there are few ways to stop them.

HOW THE NATIONAL TEAM, ITS FAMILIES AND FRIENDS BENEFIT

Even if parts of the government retain their independence of business interests, there is no doubt that the National Champions call the shots in the domestic and Hong Kong stock markets and, of course, at the CSRC. The workings of the stock markets confirm that the business of the National Champions is business in their own self-interest.

Jumbo investors in jumbo listings

Between mid-2001 and mid-2005, China experienced a severe bear market as a result of reformers tinkering with the system’s framework. By 2005, a solution acceptable to all major stakeholders—that is, all the major state shareholders—was found that enabled business to pick up where things had left off in June 2001.5 In 18 months, the Shanghai index then miraculously surged from just below 1,000 points to 3,000 at year-end 2006. The proximate key to this boom was China’s entry into the WTO process and the certainty shared among foreign and domestic investors alike that the country was open for business. But the real key to the surge was the certainty among all domestic players that the huge overhang of non-tradable shares would not come on the market until after the Beijing Olympics in 2008. With this worry put aside, all the talk was about round-trip listings (listing on the Hong Kong exchange and then returning to list in Shanghai) of the National Champions and, especially, bank listings. Then, to add jet fuel to the fire, came the gradual appreciation of the renminbi.

The confluence of these events made a hero of Shang Fulin, Chairman of the CSRC. Appointed in 2002, Shang had previously been the chairman of the Agricultural Bank of China and was firmly protectionist to the extent of removing nearly all overseas returnees from the CSRC on his arrival. He had been responsible for arresting and reversing the collapse of the domestic stock exchanges and the concurrent bankruptcy of China’s securities industry. In his attempts, he had employed every possible political and economic measure traditionally used to prop up the markets, and all had failed. In late 2004, he was provided with a workable solution by Zhou Xiaochuan’s reform group. After claiming full credit for this, Shang oversaw its implementation just as the RMB began its ascent against the dollar (see Figure 7.4). The great stock market boom of 2006 and 2007 strengthened Shang’s political position and thus put the seal to the opening of the country’s stock markets to meaningful foreign participation.

FIGURE 7.4 Shanghai Index and RMB appreciation, 2005–2010

Source: Bloomberg

At this same moment, the restructuring of the Big 3 Banks (minus ABC) was completed and their long-awaited IPOs in Hong Kong had begun. CCB listed to great fanfare in late 2005 with an H-share offering; Bank of China re-opened the domestic markets with a simultaneous Hong Kong/Shanghai IPO in June 2006; and the ICBC IPO came in October the same year with a dual Hong Kong/Shanghai listing. This period was characterized by super-large offerings; BOC’s Shanghai IPO raised RMB20 billion (US$2.4 billion) and ICBC’s offering was for a mammoth RMB46.6 billion. How did such huge amounts become available so soon after the market had tested historic lows? The friends of the family had stepped up to help out.

The prevalence of “strategic” investors in these major deals is an important factor in explaining how the market was able to get up off its knees. In similarly stagnant market conditions in 1999, the CSRC had created this third category of “strategic” IPO investors when the traditional retail and professional institutional investors failed to step up.6 What was the incentive for this new category of “strategic” investors? Until 1999, all prospective IPO investors, retail and institutional, were required to submit an application for IPO shares in a nationwide lottery. In contrast to a similar lottery system in Hong Kong, however, the submission of an application did not guarantee receipt of even a minimum lot of shares. In China, the success ratio of the lottery is applied against the number of applications submitted.

For example, a deal that is a thousand times oversubscribed means an investor has a 0.1 percent chance of having his application selected. He can enhance his odds, however, by submitting as many separate applications as he can afford, placing a full deposit with his broker to back up each bid. This is the arrangement that has led to the market’s characteristically wild oversubscriptions. To ensure even a small allocation, it is not unusual to see investors producing enough money to subscribe for the entire offering! The system is clearly biased against the small investor and in favor of big institutions with lots of money, whether borrowed from banks or their own.

The system did not work well during the stagflation of the late 1990s, so the CSRC created this category of “real strategic” investors, which was broadly defined to include everything in the Chinese economic landscape including, most certainly, listed SOEs and their parent groups. Such “strategic” investors would agree to buy a block of shares at issue price before a deal was formally launched. Although subject to a lock-up period of, generally one year, they received a full allocation of their order. In contrast, as regular investors, whether offline or online, they were not assured of receiving any allocation, much less a full one, no matter how many forms they had submitted.

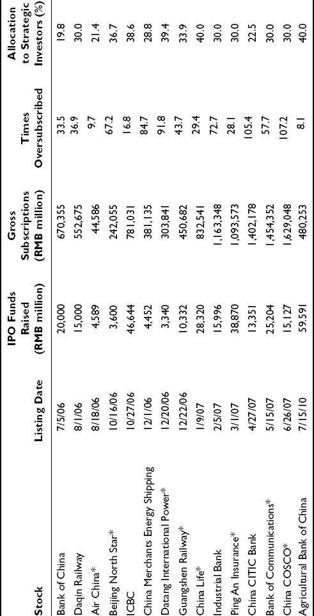

In 2006, recovering markets that had hosted no IPOs in over a year faced a potential flood of listings from the National Champions, which meant that strategic investors were once again in demand. Of the 24 Shanghai listings completed between June 2006 and June 2007, 14 benefited from the support of strategic investors, even when the amounts raised in the open lotteries were many times the IPO proceeds (see Table 7.3). For example, for ICBC’s massive IPO, 23 “strategic” investors (including a couple of the AMCs) contributed RMB18 billion (US$2.2 billion) to ensure the bank’s success (see Table 7.4). All of these investors were central government enterprises. They were given full allocations and their subscriptions represented 38 percent of total funds raised. Everyone else put in RMB781 billion for an IPO which, even though it was 17 times oversubscribed, only jumped in price by an unsatisfying five percent on the first day, showing just how weak primary markets were then and just how important, therefore, strategic investors were to completing the IPO.

TABLE 7.3 Strategic investors in Shanghai IPOs, June 2006–June 2007, July 2010

Source: Wind Information and author calculations

Note: * denotes overseas returnee listing

TABLE 7.4 Strategic investors in ICBC’s A-share IPO

Source: ICBC public notice, October 17, 2006

|

Name |

Value of shares allocated (RMB billion) |

|

|

1 |

China Life Insurance (Group) Co. |

2.0 |

|

2 |

China Life Insurance Co. Ltd. |

2.0 |

|

3 |

China Pacific Life Insurance Co. Ltd. |

2.0 |

|

4 |

China Huarong Asset Management Co. |

1.5 |

|

5 |

Ping An Life Insurance Co. Ltd. |

1.1 |

|

6 |

China Huaneng Group Co. |

1.0 |

|

7 |

China Guangdong Nuclear Group Co. Ltd. |

0.9 |

|

8 |

COFCO Group Co. Ltd. |

0.8 |

|

9 |

BaoGang Group Co. Ltd. |

0.5 |

|

10 |

Dongfeng Motors Co. |

0.5 |

|

11 |

State Development Investment Co. |

0.5 |

|

12 |

Capital Airport Group Co. |

0.5 |

|

13 |

Taikang Life Insurance Co. Ltd. |

0.5 |

|

14 |

Pacific Life Insurance Co. Ltd. |

0.5 |

|

15 |

Minmetals Investment Development Co. Ltd. |

0.5 |

|

16 |

Xinhua Life Insurance Co. Ltd. |

0.5 |

|

17 |

China Eastern Asset Management Co. |

0.5 |

|

18 |

China Offshore Oil General Co. |

0.5 |

|

19 |

China Re-insurance Group Co. |

0.5 |

|

20 |

China Yangtze Power Co. Ltd |

0.4 |

|

21 |

China Machinery Industry Group Co. |

0.4 |

|

22 |

China Nuclear Industry Group Co. |

0.3 |

|

23 |

Huatai Property Insurance Co. Ltd. |

0.2 |

|

Total |

18.0 |

Once the market picked up, however, strategic investors were no longer needed until, that is, the huge Agricultural Bank of China IPO in July 2010, which the government sought to make the world’s largest. It was able to achieve its goal of raising nearly US$9 billion in Shanghai only by relying on a group of 27 strategic investors for 40 percent of an offering that received a very weak reception and was only a little over eight times oversubscribed. This time, 50 percent of strategic allocations were subject to an 18-month lock-up period, indicating again just how weak the reception for the ABC IPO was. By comparison, CCB’s IPO raised US$1 billion less in its Shanghai offering but attracted RMB1.7 trillion (US$210 billion) in lottery applications. Then there was China Railway Group, with some US$400 billion in applications (see Table 7.6).

This arrangement served all the important parties well. It meant that the larger deals were about a third sold before they had even been announced, so the downside risk was well covered. But, most importantly, the major investors were able to access huge blocks of otherwise unobtainable shares in the “strategic” group. They were able to hedge these shares, which were by regulation locked up, by massively participating in the open online lottery, in which there was no lock-up period and which, in normal circumstances, guaranteed them eye-popping IPO returns, as discussed in the next section. The lucrative involvement of “family and friends” in an SOE’s IPO ensures that it will receive support from the same group if and when they are called upon: a favor received means a favor returned at a later date.

An example of who such friends were in the case of ABC’s IPO can be seen in Table 7.5. The biggest investors included China’s major life-insurance companies and the finance subsidiaries of several National Champions. Further down the list of 173 investors were the proprietary trading accounts of almost the entire list of the SASAC’s National Team as well as asset-management companies and the always profit-oriented Military Weapons Equipment Group Company. These offline friends accounted for 20 percent of the offering. In short, some 60 percent of ABC’s Shanghai listing was supported by the government acting through its National Team. These investors, despite the policy reason for their participation, could not have been heartened by ABC’s modest performance. The first day after listing, its shares rose only one percent, as compared to an average jump of 69 percent even in 2010’s weak market.

TABLE 7.5 Top 20 offline investors in the Agricultural Bank of China A-share IPO

Source: ABC public notice, July 8, 2010

|

Name |

Value of shares allocated (RMB million) |

|

|

1 |

Ping An Life Insurance designated accounts |

1,668.6 |

|

2 |

CNOOC Finance Co. proprietary account |

1,195.4 |

|

2 |

Shengming Life Insurance Co. designated account |

1,195.4 |

|

3 |

People’s Insurance Co. managed accounts |

929.3 |

|

4 |

Ping An Insurance Co. proprietary account |

896.6 |

|

5 |

China Pacific Insurance Co. managed account |

650.5 |

|

6 |

Taikang Life Insurance Co. managed accounts |

525.3 |

|

7 |

China Power Finance Co. proprietary account |

448.3 |

|

8 |

Xinhua Life Insurance designated account |

366.1 |

|

8 |

NSSF designated accounts |

335.9 |

|

9 |

CITIC Trust designated account |

278.8 |

|

10 |

China Aviation Engineering Finance Co. proprietary account |

149.4 |

|

10 |

Deutsche Bank QFII account |

149.4 |

|

11 |

Jiashi Top 300 Index Fund |

97.6 |

|

12 |

Daiya Bay Nuclear Power Finance Co. proprietary account |

92.2 |

|

12 |

Red Tower Securities Co. proprietary account |

92.2 |

|

13 |

Boshi Stable Value Fund |

83.4 |

|

14 |

Yifang Top 50 Fund |

72.2 |

|

15 |

Fuguo Tianyi Value Fund |

55.8 |

|

15 |

Jingshun Growth Equity Fund |

55.3 |

ABC’s IPO came in the aftermath of the Great Shanghai Bubble of 2007. From June of that year, the market entered the final stage of its heroic bubble, rising 50 percent in four months to nearly 6,100 points. Many people, caught up in the euphoria, believed the index would easily break 10,000 by year-end. During this period, 17 more companies listed on the Shanghai exchange, including PetroChina, China Shenhua Energy and CCB, and none used the formal strategic-investor route (see Table 7.6). The reason for this is simple: there was no longer any need; the market was full of liquidity and listing success was guaranteed.

TABLE 7.6 IPOs in the closing days of the Great Shanghai Bubble, 2006–2007

Source: Wind Information and author calculations

This is not to say that these IPOs did not attract the small investor. But in almost any market circumstance, the average deposit required to secure an application was far beyond the reach of any normal retail investor. During the mid-2006 to mid-2007 period, the average online “retail” bid was nearly RMB700,000; in the second half of 2007, when strategic investors were no longer needed, it rose to RMB1.2 million on average. During this period, there were more than a million online investors per IPO; PetroChina attracted over four million. So while small investors most certainly came out to help boost the number of applications, they did not account for the bulk of the money put down online: institutions did.

As for the offline tranche, the amounts of money involved could be staggering. For example, in PetroChina’s Shanghai IPO, 484 institutional investors successfully bid for allocations in an offline tranche that accounted for 25 percent of the entire share offer. The smallest successful bid was made by the appliance-maker Haier, which received 2,089 shares and was refunded RMB1.64 million from its lottery deposit. The largest was Ping An Life, which received a total of 119 million shares in a handful of separate accounts and got back RMB93.2 billion (US$11.4 billion) in excess bid deposits. Not far behind was China Life, with over 100 million shares and deposits worth RMB78.5 billion (about US$10 billion) returned. Reviewing the 400-plus names reveals a Who’s Who of China’s top financial and industrial companies, including even the Military Weapons Equipment Group Company (Bingwu Gongsi) of the People’s Liberation Army.

If one of the original goals of creating stock exchanges was, as stated, to ensure the primacy of a socialist economy overseen by the Party, then China’s experience with stocks has succeeded far beyond any reasonable expectation.

Keeping everyone happy: Primary-market performance

In addition to the lottery arrangements that create mass feeding frenzies, the share valuation mechanism set by the CSRC explains the popularity of IPOs in China. Simply put, prices are knowingly set artificially low while demand is set high, with the result that big price jumps on listing day are virtually guaranteed (see Table 7.7). This approach also eliminates underwriting risk so that securities firms need not be concerned that their underwriting fees are so thin. But this all comes at a cost. The pricing process eliminates the need for investors to understand companies and the industries in which they operate to arrive at a judgment as to valuation.

TABLE 7.7 A-share listing-day price performance

Source: Wind Information; author’s calculations; 2010 data through March 31

Note: * represents the amount of shares sold as a percentage of what was allowed to be sold on the first day.

Since the process is dumbed down to a formula, underwriters have never learned how to value companies and price risk. Even worse, the investor population, in whatever category, never became educated as to the values of different companies, the prospects for their shares, or the risks associated with investing. Over time, the result has been that companies became commodities and getting an allocation of shares, any shares, became the sole objective and wildly oversubscribed IPOs were the result. From another angle, what these valuations of China’s National Champions are most certainly not revealing is Chinese management skill, technical innovation, entrepreneurial flair, or the growth of genuine companies. What they do show is the state’s confidence in its own ability that, when push comes to shove, it can manage the market index so that it will go up and the state’s holdings will increase in value. Chinese investors refer to their stock markets as “policy” markets for this very reason: they move on the expectation of government policy changes and not on news of company performance. The fundamental value-creation proposition in China is the government, not its enterprises.

In spite of this, prices play a huge role, although not in valuing the risk related to the business prospects of companies. As mentioned, the CSRC formulas uniformly result in share valuations well below prevailing market demand so that double-digit and triple-digit first-day jumps in prices become par for the course. Put another way, the regulator requires that companies and their underwriters price shares in a completely opposite way to market practice in Western markets. Forced by their ultimate state owner, companies effectively sell their two-yuan shares for one yuan.

From an international perspective, the losses to companies arising from this practice are enormous. As an extreme example, take PetroChina. The company raised RMB67 billion (US$9.2 billion) in its Shanghai IPO and received RMB3.4 trillion (US$462 billion) in subscription deposits. The difference between its actual share price and a market-clearing price based on actual demand is shown in Figure 7.5. As indicated, PetroChina’s cheap pricing meant that it had left RMB45 billion (US$6.2 billion) on the table. Not surprisingly, on its listing, PetroChina’s shares jumped nearly 200 percent, giving it, albeit briefly, a market capitalization of more than US$1 trillion. From a developed-market viewpoint, this was a complete crime. It should have been an even bigger crime in the SASAC’s eyes, given the cheap sell-out of state assets. From the company’s viewpoint, an astute chairman would have wondered why he had just sold 10 percent of his company at half the value attributed to it by the secondary market. To put it another way, he had sold US$16.8 billion of stock for just US$8.9 billion. In an international market, he would, no doubt, have fired his investment bankers outright and then been fired by his board.

FIGURE 7.5 Money left on the table

Source: Wind Information and authors’ calculations

But this money, as shown previously, was hardly lost to the state: it had just been given to those state-owned institutions, the group of “family and friends” that had participated in the prearranged lottery. From this, it seems that IPOs function as a means to redistribute capital among state entities with, possibly, some leakage into the hands of retail investors and mutual-fund holders to smooth things out.

The looking-glass culture of these markets creates figures such as the chairman of China Shenhua Energy, Chen Biting, who could say without a trace of irony: “The debut price was within expectations, but I am still a wee bit disappointed.”7 His lament was that on the first day of Shenhua’s IPO, its shares jumped only 87 percent, leaving just RMB15 billion on the table for his friends. Such generosity characterized the highs of the 2007 stock bubble and Chen was no doubt looking for a doubling of his company’s share price. If he had been running PetroChina, he would have been much happier, it seems. After all, PetroChina’s chairman, Jiang Jiemin, could look his buddies straight in the eyes, knowing that he had delivered for them and the Party that backed them all up. More importantly, he knew that he could now count on their continued support should he need it.

For those in the central nomenklatura of the Party, there are no independent institutions, only the Party organization and it is indifferent as to which box does what. On the other hand, just think how relieved the two AMC investors in ICBC’s Shanghai IPO must have felt, knowing they had made enough quick money to pay interest on the PBOC and bank bonds.

Whose hot money?: The trading market

The stock market money-machine works best when IPO prices are cheap and there is huge liquidity in the trading market. This environment drives up the prices of “strategic” investments locked up in the hands of the state investor pool. As is the case in the IPO market, this money does not come from retail investors, as the state would have us believe. From roughly 1995 until the present day, the Chinese secondary markets have been dominated by institutional traders; that is, SOEs and state agencies. Their investment decisions move the market index. While much of the evidence is anecdotal, it has been estimated that anywhere up to 20 percent of corporate profits came from stock trading in 2007. The authors themselves once received a call from a recently listed company asking for advice on how to set up an equity trading desk now that management had some cash in hand. Given the ability to achieve a return greater than the bank deposit rate and the ease with which trading can be disguised, why wouldn’t a corporate treasurer look to make some easy money while the market is running hot?

Based though it is on sparse public information, Table 7.8 provides a rough breakdown by types of investors in Chinese A-shares at the end of 2006, just as the market was beginning its historic boom. The market reforms of 2005 notwithstanding, shares owned in various ways by the original state investors remain locked up. As a result, the tradable market capitalization is a known figure and at FY2006 totaled US$405 billion. The figure for domestic mutual funds is published quarterly. The retail number is based on the assumption that half of retail investors invest through mutual funds and half invest directly. If accurate, this would mean that retail investors account for nearly 30 percent of the traded market; this is considered to be a high estimate. The size of total Qualified Foreign Institutional Investor (QFII) quotas is publicly known, although the investment mix is not, and the NSSF and insurance companies at this time had known restrictions as to how much they could invest in shares. The assumption in each of these three cases is that 100 percent of their approved quotas was placed in equities; this yields a US$30 billion estimate. Netting all of these knowable fund sources out of the tradable market means that some 60 percent, or US$245 billion, of the A-share float as of year-end 2006 cannot be linked to identifiable categories of investor.

TABLE 7.8 Investors in China’s stock markets, December 31, 2006

Source: China Economic Quarterly 2007 Q1, p. 11

|

US$ billion |

% of Total |

|

|

Total A-share market capitalization |

1,318 |

100.0 |

|

Less: capitalization under three-year lock-up |

913 |

69.3 |

|

Tradable market capitalization |

405 |

100.0 |

|

Total identifiable institutional investors including: |

100 |

24.7 |

|

- Domestic funds (actual number) |

60 |

14.8 |

|

- QFII (100% of existing total approved quota) |

20 |

4.9 |

|

- Securities companies estimate |

10 |

2.5 |

|

- NSSF (100% of approved limit) |

5 |

1.2 |

|

- Insurance companies (100% of approved limit) |

5 |

1.2 |

|

Estimated retail investors |

60 |

14.8 |

|

Estimated other investors including: |

245 |

60.5 |

|

- State agencies |

115 |

28.4 |

|

- State enterprises |

65 |

16.0 |

|

- Large-scale private investors |

65 |

16.0 |

Who are these unknown investors that own the majority of the A-share float? Almost certainly, they include many overseas Chinese tycoons who have the wherewithal to evade the prohibition on foreign individual investments in A-shares. More interestingly, during the market ramp-up in 2006, many domestic financial reporters believed the market rumor that China’s army and police forces alone had brought onshore upward of US$120 billion and committed it all to stock investments. While this figure is outlandish, it may have been possible that a smaller amount had been repatriated and invested just as the market began its upward move in 2006, resulting in this much higher value. But there can be no doubt that SOEs and government agencies between them must have held some US$180 billion in tradable shares in addition to shares they held subject to a lock-up.

A CASINO OR A SUCCESS, OR BOTH?

It has been nearly two decades since the Shanghai and Shenzhen exchanges were established. Why, if they are still regarded as casinos, have they been so successful? How have they come to be seen as beacons of China’s economic reform and attained such central roles in the country’s economic model? The answer is simple: you can make money from them. These markets are driven by liquidity and speculative forces, given the almost-arbitrary business decisions made by companies influenced more by politics than profit. How can this not be the case when companies are the property of the Party and its families?

Such a market may seem daunting to investors from developed markets, but the Chinese are long accustomed to operating in a No Man’s Land of political interference and contradictory signals. None of this stops them from playing or being played by the market: if you buy a share at RMB10 and sell at RMB15, you do make RMB5. Putting money on deposit with banks or playing the bond market is hardly worth the effort; interest rates are set in favor of state borrowers, not lenders, so they do not provide a real return over the rate of inflation.

In China, the only two ways to make this real return are property and the stock markets. Of the two, the stock markets are preferable since they are more flexible than the property market (not that those with the means cannot play both). The investment measure in stocks may be smaller, but liquidity is substantially better than the property market. In contrast to interest rates, the equity market equivalent, the price-to-earnings (PE) ratio, is free to run as high as the market will take it. In the glory days of the Golden Bull Market from 2006 to 2007, the overall Shanghai PE multiple rallied from 15 to nearly 50 times. With that sort of valuation expansion, the upside is very large indeed.

The Chinese market simply doesn’t have natural stock investors: every body is a speculator. Chinese history and bitter experience teach that life is too volatile and uncertain to take the long-term view. The natural result of this is a market dominated by short-term traders, all dreaming of a quick return. The one natural investor is the state itself and it already owns the National Champions. In contrast, ownership in developed markets is far more diversified; large companies simply do not have dominant shareholders owning more than 50 percent of their shares. For example, the largest shareholder of Switzerland’s biggest banking group, UBS, is the Government Investment Company of Singapore, with less than a seven percent holding. Contrast that with Bank of China: even after its IPO the bank’s largest shareholder, Huijin, still controlled 67.5 percent of the bank’s stock.

Since China’s stock markets, which include Hong Kong, are not places that decide corporate control, the pricing of shares carries little weight when thinking about the whole company simply because it is never for sale. This is why there is no true M&A business in China and most definitely none involving non-state or private enterprises acquiring listed SOEs. Instead, market consolidation is driven by government fiat and is accomplished by mixing listed and unlisted assets at arbitrary valuations. This leaves share prices to simply reflect market liquidity and demand at any given time. The high trading volumes in the market are its most misleading characteristic since they give outside observers the impression that it is a proper market. High volumes lend credibility to the idea that prices are sending a signal about the economy or a company’s prospects. In fact, in China, all that the volume represents is excess liquidity.

All markets are driven by a mixture of factors, including liquidity (how much money is in the system); speculation (the belief in making a profit from market volatility); and economic fundamentals (the underlying business prospects and performance of listed companies). Chinese markets are often seen to be decoupled from the actual economic fundamentals of the country. A rough comparison of simple GDP growth and market performance would certainly show minimal correlation between the two. As long as Chinese A-shares ignore economic fundamentals, the market will always be thought of as a casino and too risky for most investors. Chinese investors, however, instinctively know what they are buying because they think the share price is going up, not because the company that issued the shares is having a great quarter or the economy is having a record year.

Much of the effort over the 1990s to develop the markets was aimed at strengthening this fundamental component by creating or introducing more long-term institutional investors, as in developed markets. The entire domestic mutual-fund business was created by the CSRC in the late 1990s with this in mind. The introduction of foreign investors in 2002 via the QFII facility was another step in this direction. The growing volume of company and economic research from local and foreign brokerage houses is all based on the belief that China’s markets are becoming, or will become, more fundamental and driven from the bottom up.

This entire effort is misdirected. It isn’t the absence of equity research that makes the market a casino. It is the absence of genuinely accountable companies subject to market and investor discipline. If the chairmen/CEOs of China’s major companies care little about the SASAC, they care still less about the Shanghai stock exchange or the legion of domestic equity analysts. The CEO knows full well that his company possesses the resources to assure the performance of its own shares. The National Champions dominate China’s stock markets, accounting for the lion’s share of market capitalization, value traded and funds raised.

The growing number of private (non-state) companies listed on Shenzhen’s SME and ChiNext boards is encouraging, but most of these companies, with few exceptions, are tiny in the broader market context. Perhaps investors can look at the SME or ChiNext market and apply the usual investment analysis used in the international markets, but how can an investor look at PetroChina and compare it with ExxonMobil when it is nearly 85 percent controlled by the state and will remain so as long as the Party remains in power? It is the same with China Mobile or China Unicom; can they really be compared with Vodafone, T-Mobile, or BhartiAirtel? The fact that foreign telecommunication providers are barred from China’s domestic market means that China Mobile and China Unicom have a comfortable duopoly. Their privileged positions are simply not subject to the same regulatory or market checks and balances that their global peers face.

The fact that the National Champions are all jumping at the chance to invest in China’s suddenly undercapitalized banks surely flags the question of whether National Champions can be looked upon as genuine companies or simple extensions of the government. How else to view China Mobile’s acquisition of a 20 percent “strategic” stake valued at US$5.8 billion in the Shanghai Pudong Development Bank, or China Unicom’s investment in the Bank of Communications, or Alibaba.com’s (China’s Google) investment in China Minsheng Bank?

IMPLICATIONS

Hovering over all this activity are the CSRC and the state in general. The state is involved at every stage of the market as the regulator, the policymaker, the investor, the parent company, the listed company, the broker, the bank and the banker. In short, the state acts as the staff for China’s major SOEs. With the National Team formed and with its senior management being coterminous with the very center of political power, can there be any true reform of corporate governance? Is it likely that they would accept the creation of a Super Regulator with real authority over the market and their own conduct? With the existing regulator already on their side, ensuring that the market is tuned in their favor, why would they want foreigners with their own ideas of how markets operate to have significant influence? So, no meaningful opening to foreign participation can be expected. In fact, the scope of foreign influence can be expected to be cut back even further as Chinese securities companies, law firms and auditors assert themselves and Chinese-style regulation is extended from Shanghai to Hong Kong.

In late 2009, the first material step in this direction took place when the Hong Kong Stock Exchange indicated it would accept Chinese firms as auditors for Chinese companies listed on the Hong Kong exchange subject to their vetting by the MOF or the CSRC. Ostensibly, this was done to make Hong Kong more competitive with Shanghai, since Chinese auditors are far less costly than major international firms. Since the quality and reliability of disclosure is what this is all about, can international investors expect local firms charging one-third the price to produce meaningful financial reports of increasingly complex national companies? As for vetting by the MOF or the CSRC, one might expect a handful of firms to receive approval and that these firms would be quite attentive to the needs of the National Team and their staff. If foreign investment banks and others are now struggling to establish a presence in China’s domestic markets, it can only be because they know that their days in the lucrative Hong Kong market are numbered.

Since China Life’s IPO on the New York Stock Exchange in 2003 was investigated for a possible Sarbanes-Oxley violation (there was none), no other members of the National Team have listed there. Instead, Hong Kong became the venue of choice. Now the overseas “returnees” are moving back to Shanghai where things, as one SOE chairman put it, are “a bit easier to manage”. This trend of events is quite ironic if it is considered in the context of why China opened its border to international share offerings. When Zhu Rongji gave the go-ahead for overseas listings in 1993, one of the key reasons was that the more professional and demanding standards of the Hong Kong regulators and international legal and accounting standards would upgrade the management capacity of China’s enterprises. Would Zhu now believe that after less than 20 years, his goals for China’s SOEs and their management have been achieved?

ENDNOTES

1 The NDRC’s predecessor was the State Planning Commission (SPC), which was founded in 1952. The SPC was renamed the State Development Planning Commission (SDPC) in 1998. After merging with the State Council Office for Restructuring the Economic System (SCORES) and part of the State Economic and Trade Commission (SETC) in 2003, the SDPC was restructured into the NDRC.

2 See Kjeld Erik Brodsgaard, “Politics and business group formation in China—the Party in control?” unpublished manuscript, April 2010.

3 If it can be found, see Caijing ![]() 176, January 8, 2007: 28–44. The issue was pulled from the market the day it was published.

176, January 8, 2007: 28–44. The issue was pulled from the market the day it was published.

4 Ibid.: 42.

5 See Walter and Howie 2006: Chapters 9 and 10.

6 There are two major investor categories at present: 1) the “strategic investor” (zhanlue touzizhe ![]() ) who participates prior to the formal announcement of the transaction, gets a full allocation, but is subject to a one-year lock-up; and 2) those investors participating after the formal announcement, of which there are two types: a) the “offline” “regular legal person investor” (yiban faren touzizhe

) who participates prior to the formal announcement of the transaction, gets a full allocation, but is subject to a one-year lock-up; and 2) those investors participating after the formal announcement, of which there are two types: a) the “offline” “regular legal person investor” (yiban faren touzizhe ![]() ), who is subject to a three-month lock-up; and b) the “online” investor, which includes retail and any other investor desiring to participate, who is not subject to any lock-up. In this last category, investors participate in the lottery and orders are subject to allocation.

), who is subject to a three-month lock-up; and b) the “online” investor, which includes retail and any other investor desiring to participate, who is not subject to any lock-up. In this last category, investors participate in the lottery and orders are subject to allocation.

7 “Shenhua soars 87 percent but chief still not happy,” South China Morning Post, October 10, 2007.